IR35

If your business does meet the above conditions then there are two ways to determine the IR35 status of your workers. In August this year the new Prime Minister indicated that there would be a review of the IR35 rules.

What does IR stand for in IR35.

. We use some essential cookies to make this website work. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000. The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below.

IR35 is tax legislation intended to stop disguised employment. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a. The IR35 rules will result in an increased tax and NI.

The off-payroll working rules apply on a contract-by. Definition of IR35 IR35 is the term commonly used to refer to HMRCs off-payroll working rules. The rules to counter alleged tax avoidance via the use of personal.

The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. On September 23 the UK Government announced their mini-budget.

These rules allow HMRC to collect Income Tax and National Insurance in. Definition of IR35 IR35 is the term commonly used to refer to HMRCs off-payroll working rules. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the.

October 17 2022 802 AM 2 min read. IR35 is another name for the off-payroll working rules. Speaking to the House of Commons today September 23 Chancellor Kwasi.

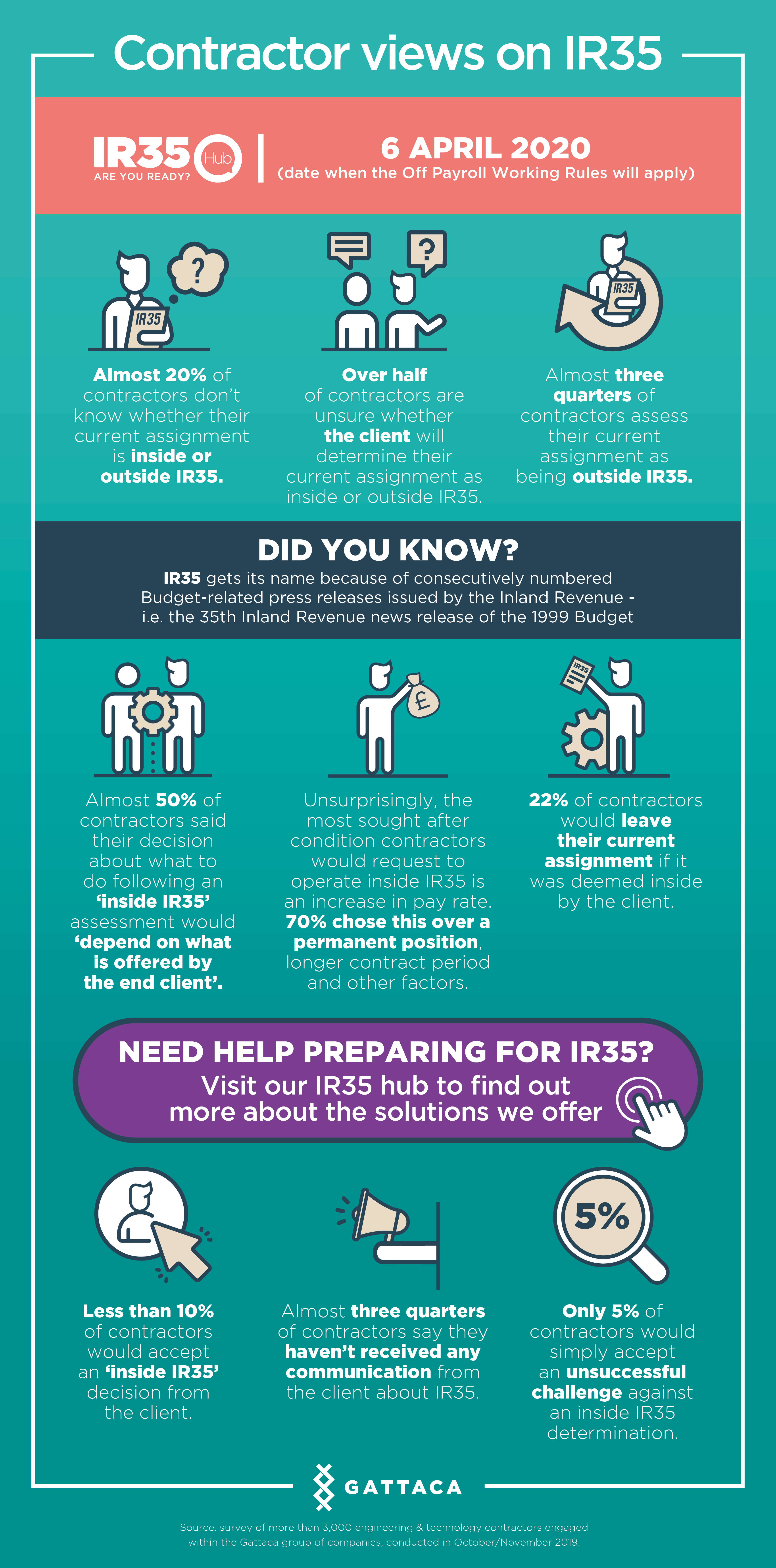

The term IR35 refers to the press release that originally announced the legislation in 1999. IR35 guide for hirers. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to.

And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. IR35 formally known as off-payroll working rules are stipulations which ensure contractors who are working for companies are paying the correct amount of tax.

The new chancellor Jeremy Hunt has scrapped the IR35 reform repeal that was planned by his predecessor Kwasi Kwarteng. Ad Global Leader In Industrial Supply And Repair Services. Wed like to set additional cookies to understand how you use GOVUK.

The Intermediaries Legislation aka IR35 was first mentioned in a 1999 Inland Revenue press release. List of information about off-payroll working IR35. While IR35 had previously been present within the.

These rules allow HMRC to collect Income Tax and National Insurance in. IR35 reforms introduced in the public sector in 2017 and. It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their.

However without any warning the Chancellor has announced the entire. The IR stands for Inland Revenue and. September 23 2022 134 pm.

IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company. IR35 was introduced in 2000 and the IR35 rules became law via the Finance Act 2000. IR35 is a piece of legislation which allows HMRC to treat private contractors as if they were employees.

The term IR35 refers to the press release that originally announced the legislation in 1999. It was introduced to combat the problem of disguised employment. Essentially IR35 affects all contractors who do not meet HMRCs definition of self employment.

In general IR35 shifts the responsibility of worker. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. Browse Our Site Today.

What Is Ir35 Off Payroll Changes For Self Employed Thinkremote

Are You Ready For The New Ir35 Rules Fuse Accountants

Ir35 The Good The Bad The Ugly Blog Explore Group Usa

Ir35 Reform April 2021 What It Means For Companies In The Usa Cxc Global

Latest Twist In The Ir35 Story Another Reminder Of Its Fundamental Flaws Ipse

Free Guide To Determining Ir35 Status The Curve Group

Working Practices Reflecting Genuine Outside Ir35 Assignment

Ir35 Repealed What You Need To Know Blog Explore Group Usa

What Is Ir35 And Why Is It Dangerous Ground For Independent Contractors

Ir35 Changes 2020 2021 Guidance For Contractors Updated Taylor Hopkinson

Changes To Off Payroll Working Ir35 Rsm Uk